PROXY SUMMARY

VisionWe will be the preferred and trusted provider of the energy our customers need. MissionWe provide our customers the safe, clean, reliable energy services they want and value at a competitive price. Values

Strategic Priorities

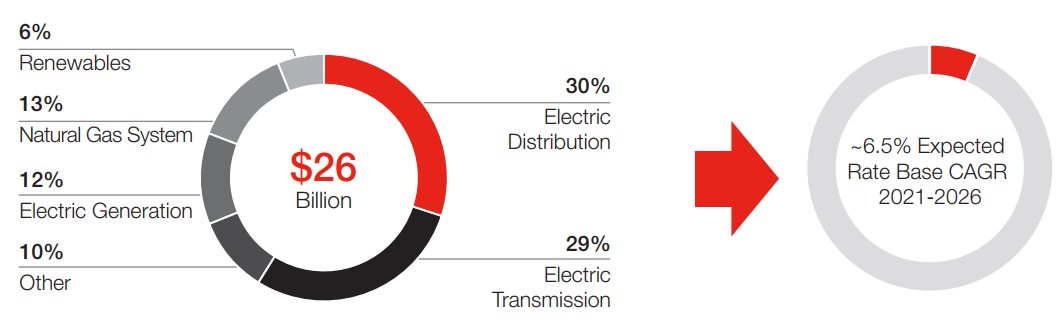

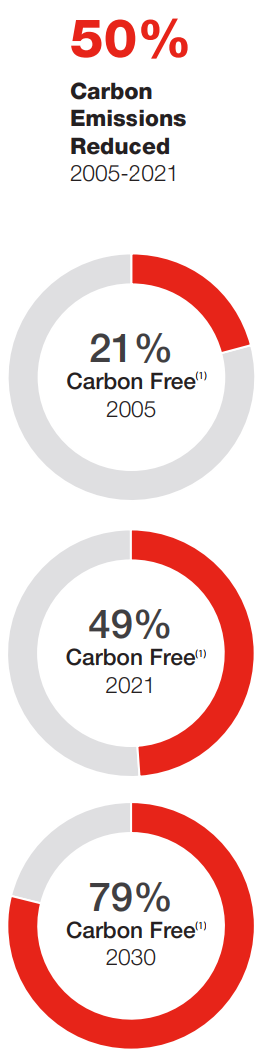

Sustainability GoalsSustainability is embedded in our strategy.

(1) Includes owned and purchased electricity provided to customers.

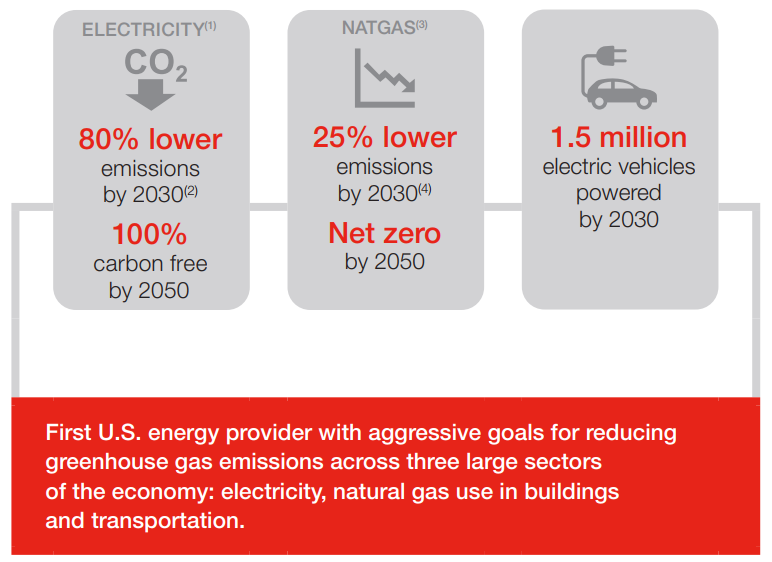

Clean EnergyOur carbon goals and reporting are third-party verified and our goals align with science-based scenarios likely to limit warming to 1.5 degrees Celsius from preindustrial levels. Changing Energy Mix

Well over 60% of energy projected to be from renewables by 2030, with full

exit from coal by 2034.  (1) Carbon free includes nuclear, wind, solar and other renewables; other energy includes coal and natural gas.

Responsible Transition

Energy plans for Colorado and the Upper Midwest are expected to reduce carbon emissions by more than 85% by 2030 while supporting employees and communities impacted by coal retirements. Through community partnership and advanced planning, we help sustain local tax base and offer employees retraining and relocation opportunities. We have closed seven coal plants to date with no layoffs. Environmental Improvements Since 2005(2)

Sulfur Dioxide

82%

Nitrogen Oxides

82%

Mercury

91%

Coal Ash

55%

Water Consumption

29%(2) Reductions from Xcel Energy generating plants except for water consumption, which is based on owned and purchased generation. Customers and CommunitiesXcel Energy offers some of the most comprehensive and innovative customer solutions in the industry.

Keeping Bills Low

Since 2013, we have kept average residential bill increases below 1% annually by diligently controlling operating and maintenance expenses and investing in economic renewables that save customers money. > 60,000 electric vehicles powered in our service area and ~1,200 charging ports installed as we launched new programs for all types of customers > 300,000 smart meters installed with plans for > 1 million in 2022, providing customers with more control and improved reliability $1 billion in investment and 5,000 jobs added in communities through 20 economic development projects Human CapitalWe are a benchmark company for our industry-leading Safety Always approach, and our diversity, equity and inclusion ("DEI") focus is fostering a culture where everyone is accepted and respected. 6%  female female5%  diverse representation

among senior leadership in the

last three years(3) diverse representation

among senior leadership in the

last three years(3)

100% employees trained on unconscious bias and microinequities > 30% executive sponsorship participants promoted or accepted positions that support their career aspirations ~13% spent with diverse suppliers on goods and services, totaling $560 million (3) Senior leadership includes vice presidents and above; diverse refers to ethnicity and race. The Governance, Compensation and Nominating ("GCN") Committee has primary board responsibility for environmental, social and governance

("ESG") issues and risks. Our Chief Sustainability Officer, who reports to the CEO, is responsible for sustainability and ESG-related policy, strategy,

governance and reporting. Please see Sustainability and ESG Oversight on pages 21 to 22 for further information.

Governance Best Practices

Shareholder Rights

Effective Oversight

Strategy and Direction

Performance Monitoring

Key Focus Areas

Directors bring extensive and relevant business, leadership and community experience (statistics below are based on our current Board composition). 23%female

15%ethnically and racially

diverse

92%independent

7 yearsaverage tenure

96%average attendance at

Board and committee

meetings

Continuous Improvement and Operational ResiliencyThe Board, through the Operations, Nuclear, Environmental and Safety ("ONES") Committee, has formal oversight of initiatives that drive continuous improvement and operational excellence in an ever-changing environment. Directors engaged this past year on enhancements to our Safety Always approach, which focuses on eliminating life-altering injuries through a trusting, transparent culture and the use of critical controls, and our COVID-19 response, wildfire mitigation and other programs that elevate safety and operational resiliency. Corporate Board Member magazine recognized the Xcel Energy Board in 2021 for leadership in advancing sustainability

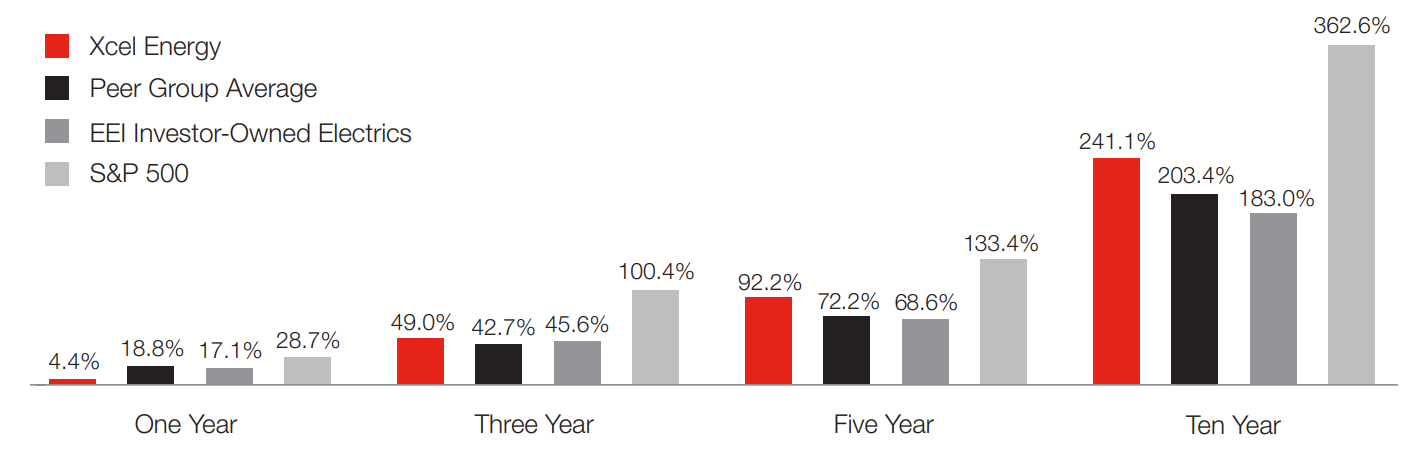

Competitive Total Shareholder Return

Strong Track Record of Sustained Growth

(1) Compound Annual Growth Rate.

(2) Ongoing earnings per share ("EPS") is a non-GAAP number and is defined in Exhibit A, which reconciles this amount to GAAP EPS for each period. (3) The dates used to calculate the 2021 stock price change were December 31, 2020 and December 31, 2021. Deliver long-term annual EPS growth of 5-7%

(1) Compound Annual Growth Rate.

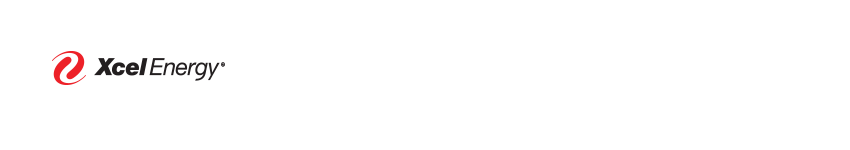

(2) Ongoing earnings per share ("EPS") is a non-GAAP number and is defined in Exhibit A, which reconciles this amount to GAAP EPS for each period. (3) The dates used to calculate the 2021 stock price change were December 31, 2020 and December 31, 2021. Positioned for the FutureCapital Forecast 2022-2026

Colorado and

Minnesota resource

plans include ~10

gigawatts of new

renewables over the

next decade, with

significant

transmission

investment

anticipated to enable

those resources.

This forecast does not include potential incremental investment of $1.5 to $2.5 billion for ~2,000 megawatts of proposed renewable energy additions under the Colorado and Minnesota resource plans and transmission associated with the Colorado resource plan.

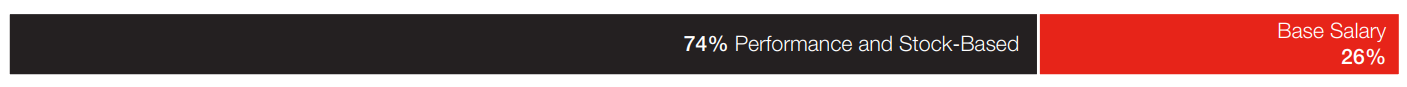

Performance Based

Majority of executive compensation variable and

at risk

Motivates achievement of financial, operational and environmental goals, set

at levels that are challenging yet achievable

Bob Frenzel, CEO

All Other Current NEOs (average)

Market Competitive

Competitive target pay opportunities,

program design and challenging

performance goals set annually

Set in consideration of our industry

peer group

Enables us to attract, motivate and

retain talented leaders

Aligned with Strategic ObjectivesLong-term Incentive Grants

|