Proxy Summary

How to Vote

If you held shares of Xcel Energy common stock as of the record date (March 21, 2019), you are entitled to vote at the annual meeting.

Corporate Governance

Our proven track record of strong financial and operational performance is rooted in a foundation of sound governance practices, an engaged and talented Board, and a focus on corporate culture. Sound Practices

Right Structure

Shareholder Rights

Governance Best Practices

Effective Oversight

Strategy and Direction

Performance Monitoring

Key Focus Areas

Diverse and Engaged Board

Experience

Diversity

Engagement

Xcel Energy's ValuesXcel Energy's strong corporate culture is rooted in our values. In 2018, the Board adopted and committed to a refreshed set of corporate values that guides all that we do.

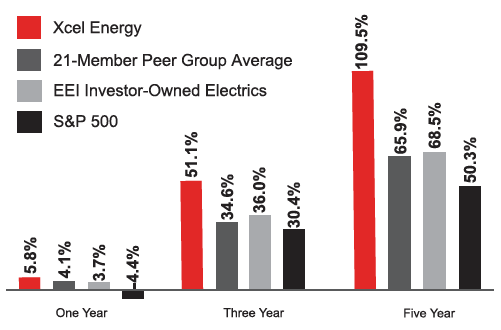

Financial Results

Our strategy has allowed us to deliver strong results for shareholders, customers and policymakers alike. 2018 results extend our track record of solid performance. Strong Total Shareholder ReturnProven Track RecordMet or exceeded ongoing EPS guidance for 14 consecutive years Increased dividend for 15 consecutive years

(1) Ongoing EPS is a non-GAAP number and is defined in Exhibit A, which reconciles this amount to GAAP EPS for each period.

(2) Compound Average Growth Rate. Positioned for the Future

Additional growth opportunities in clean energy, electrification, and economic development support a 5 to 7 percent growth rate Strategic Priorities

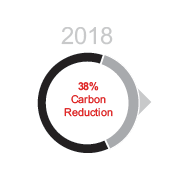

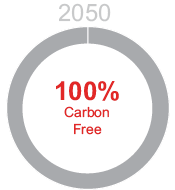

Our strategic priorities sharpen our focus and set the course for delivering outstanding results over the long term. Lead the Clean Energy TransitionFirst US utility to set a goal of 100 percent carbon-free electricity by 2050 On track to reduce the carbon emissions from electricity serving our customers by 80 percent by 2030 compared to 2005 levels Positioned for cross-industry growth through electrification

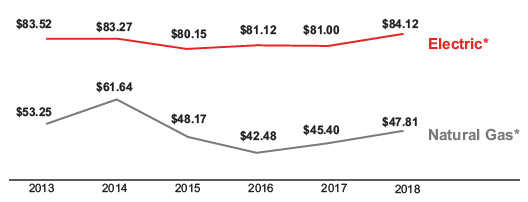

Keep Bills LowExtensive suite of efficiency programs Disciplined cost management across the enterprise Steel for Fuel projects lower bills while reducing carbon * Source: Based on data reported to the EIA. Figures are annual average of monthly bills, excluding taxes

and franchise fees.

Enhance the Customer Experience99.9% electric service reliability $194 million invested in natural gas safety upgrades Several 100% renewable electricity options available to customers, with more in development Supporting electric vehicle use through in-home charging, public infrastructure, and partnerships New capabilities that improve convenience and enhance communication, driving increased customer satisfaction Corporate Responsibility

We are proud to play a unique and important role in supporting customers and communities as we transition to a cleaner energy supply mix. Environmental ResponsibilityCleaner Air

Energy Efficiency

Social ResponsibilityActive Support for Communities

Engaging and Rewarding Workplace

GovernanceStrong Governance and Clear and Transparent Disclosure

Results-Driven Compensation

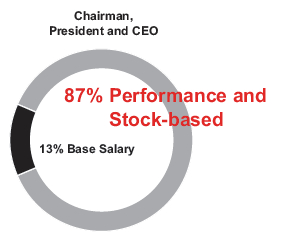

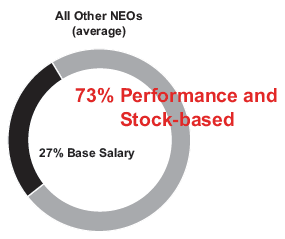

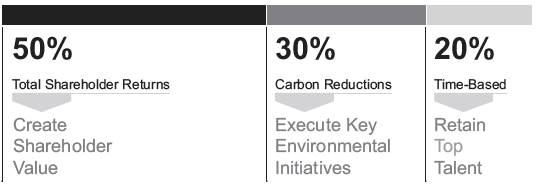

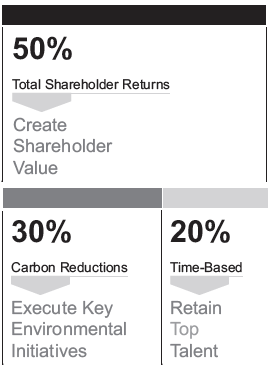

Our compensation and programs are performance-based, market-competitive, and aligned with our strategic priorities, linking incentive opportunities to the performance expected of us by our shareholders and customers. Performance BasedMajority of executive compensation is at risk Motivates achievement of financial, operational and environmental goals

Market CompetitiveProgram design and metrics set annually Set in consideration of 21-member industry peer group Enables us to attract and retain talented leaders Aligned with Strategic ObjectivesLong-Term Incentive Grants   | ||||||||||||||||||||||||||||||||||||